Why is it important not to purchase insurance based on the lowest premium?

by Munro Deysel

by Munro Deysel

The premiums underwriters charge, are direct proportional to the risk they are prepared to

underwrite and the level of cover they are prepared to give.

For higher premiums one can expect the acceptance of a higher risk and higher levels of

cover.

Lower premiums reflect lower risk acceptance and the limitations of the types and

amounts of cover they provide.

Low premium policies e.g. will limit hospitalisation to R1,000 per claim and R2,000 per annum. Prescription medicine

e.g. will be limited to per claim R750. These are all wholly inadequate levels of cove. Ask for the schedule of benefits before you sign up for anything.

The simple rule is that the more you pay, the more you get; the less you pay, the less you get.

Buyer beware!

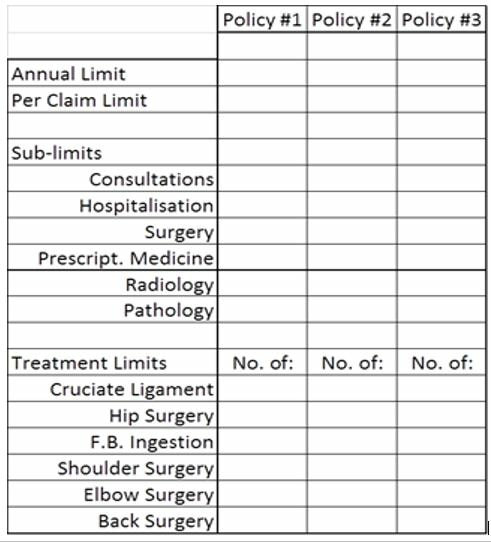

Pet medical insurance is a complex product and to understand all the terms and conditions of any one of the policies available in the market is difficult. To do a comparative analysis of some is even more perplexing.

In order to help our readers to do a comparative analysis before committing to any product, we provide you with the following table and some questions provided below:

underwrite and the level of cover they are prepared to give.

For higher premiums one can expect the acceptance of a higher risk and higher levels of

cover.

Lower premiums reflect lower risk acceptance and the limitations of the types and

amounts of cover they provide.

Low premium policies e.g. will limit hospitalisation to R1,000 per claim and R2,000 per annum. Prescription medicine

e.g. will be limited to per claim R750. These are all wholly inadequate levels of cove. Ask for the schedule of benefits before you sign up for anything.

The simple rule is that the more you pay, the more you get; the less you pay, the less you get.

Buyer beware!

Pet medical insurance is a complex product and to understand all the terms and conditions of any one of the policies available in the market is difficult. To do a comparative analysis of some is even more perplexing.

In order to help our readers to do a comparative analysis before committing to any product, we provide you with the following table and some questions provided below:

- What is the per claim excess?

- Does your policy have a co-payment period? If so, what are the terms thereof?

- What are the routine care benefits of your policy?

- What are the chronic care benefits of your policy?

- What is the minimum and maximum age limits for accepting pets onto you policy?

- Does your policy provide cover for life once the pet is on the policy?

- Do you have any breed exclusion(-s)?

- May I use the vet of my choice?

- Do you provide pre-authorisation, financial guarantees and direct payments to vets?

- Do you provide multiple pet discounts?

- Do you allow for annual premiums? Are they discounted?

- Once I have submitted all documentation, in how many work days will you settle my claim?

There are many other questions and the product comparison can be done in much more detail, but

getting the information and answers to all the questions will enable any pet owner to make an informed decision.

|

Although none of us like to think about this aspect of our dogs, aggression in dogs is very real, and when this is targeted towards members of the family and people that are familiar to the dog, you are facing a very dangerous situation.

|

How is it that somebody that just wants to help animals, ends up in a situation like this?

|

With the rising cost of vet fees, the availability of specialized treatment and the low rand, which makes imported meds so expensive, we really do need to consider pet insurance so that we can afford to give our pets all they need

|